INVESTMENT INSURANCE

Seguro Top Selection

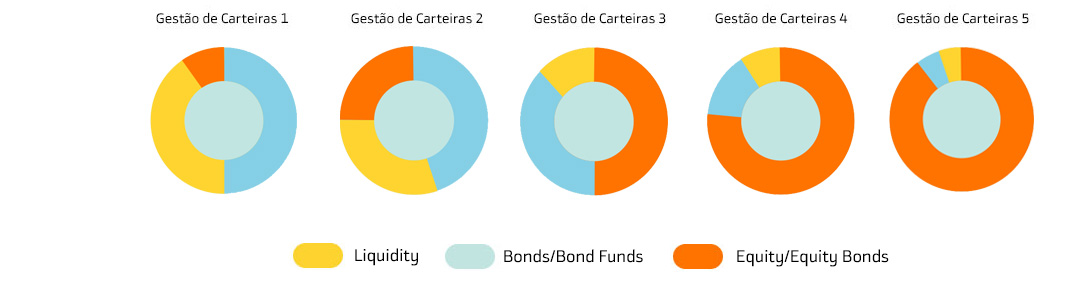

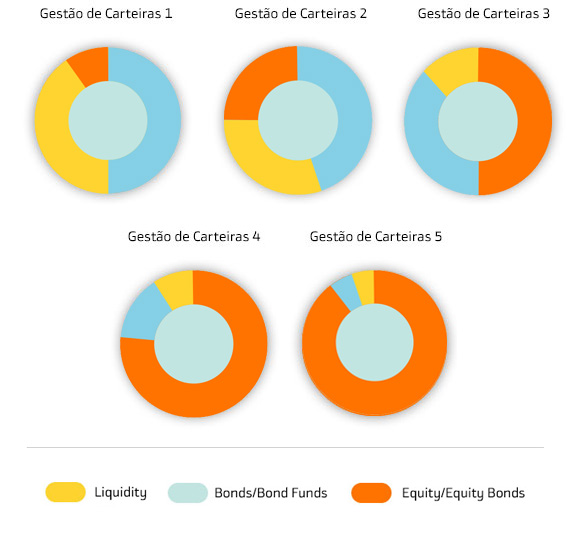

Gestão de Carteiras.

Medium and long-term investment insurance.

Example merely illustrative. Fund allocations may differ from those presented in the chart as a result of active management. The greater the amount invested in shares, the higher the potential return, but also the risk of capital loss.

Why invest in Seguro Top Selection Gestão de Carteiras?

| Diversified funds adapted to different investor profiles. Diversified solutions for different assets classes, geographical areas and types of investment, available for different investor profiles, from least to most dynamic. | |

| Personalised report with individualised statement. Regularmente, é enviada informação do desempenho, ativos subjacentes, movimentos e ainda um comentário de mercado elaborado por profissionais, tudo num único extrato. | |

| Monthly sheet. Contains detail on the conditions of sale, a graphic alert of each autonomous fund, investor warnings, investment rationale, identification of the insurance company and marketing entity, investment policy, composition of the portfolio by assets classes and geographical area and also the monthly market commentary drawn up by the Asset Management team of Bankinter. |

General Conditions

- Minimum investment amount: 25.000 EUR

- Additional subscriptions: 5.000 EUR

- Daily liquidity: applied amounts may be redeemed at any time

- Term: up to 20 years

| Autonomous funds | Subscription Fee1 | Transfer Fee | Redemption Fee | Management Fee (Chargeable to the fund) |

| TS Gestão de Carteiras 1 | 0,00% | 0,00% | ≤ 1 year: 0,50% Subsequent years: 0,00% | 1,00% |

| TS Gestão de Carteiras 2 | 0,00% | 0,00% | ≤ 1 year: 0,50% Subsequent years: 0,00% | 1,25% |

| TS Gestão de Carteiras 3 | 0,00% | 0,00% | ≤ 1 year: 0,50% Subsequent years: 0,00% | 1,25% |

| TS Gestão de Carteiras 4 | 0,00% | 0,00% | ≤ 1 year: 0,50% Subsequent years: 0,00% | 1,50% |

| TS Gestão de Carteiras 5 | 0,00% | 0,00% | ≤ 1 year: 0,50% Subsequent years: 0,00% | 1,50% |

Tax Benefits

Capitalization insurance has tax advantages, with a lower income tax rate, when compared with the rate applicable to other savings products.

When the investment in the first half of the contract is, at least, 35% of the total

invested, the tax is:

- 28% if redeemed by 5 years

- 22.4% if redeemed between the 5th and 8th year

- 11.2% from the 8th year

No taxes will be payable in the event of death and succession. The capital and income are not subject to stamp duty.

Useful Information

This does not dispense with consulting the legally required pre-contractual and contractual information.

This does not dispense with consulting the legally required pre-contractual and contractual information. The Key Information Document may be consulted in any Bankinter branch or at bankinter.pt.

Seguro Top Selection Gestão de Carteiras is a product of Insurance Company Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros, marketed by Bankinter, S.A., Branch office in Portugal. Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros with registered office at Avda. de Bruselas, 12 28108 Alcobendas, Madrid, Spain, offers to its customers, asset management products and services, through its branch office in Portugal. Bankinter Seguros de Vida, S.A. is supervised by the Dirección General de Seguros y Fondos de Pensiones (Spanish Supervisory Authority) in Spain, in the capacity of regulatory body of the origin state, without prejudice to the recognized authority of Autoridade de Supervisão de Seguros e Fundos de Pensões (Portuguese Supervisory If you wish to make a complaint regarding any contract, matter or service provided, this may be made personally, in writing (post, fax, email) or by telephone to Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros, and you may also refer to Provedor do Cliente Bankinter Seguros de Vida, S.A., Branch office in Portugal (Claims Representative). If any complaint is made to the insurer by the policyholder, insured person or beneficiaries, regarding the contracted insurance, and is not solved satisfactorily, action may be taken by the Portuguese Supervisory Authority, without prejudice to the right to appeal to the competent Court.

This document was issued and approved by the Intermediary and Bankinter Seguros de Vida. It is an advertisement, not a prospectus, and doesn’t intend to constitute the only basis for the evaluation of any product or service nor a personal recommendation. The investor must seek the advice of his adviser(s) regarding the impact, particularly on tax, which any investment may have on their personal situation. All forecasts and opinions contained in this document correspond to our assessment at the time the document was created and may be subject to subsequent changes without any prior warning. Past performance is no guarantee of future performance. This document is strictly private, confidential and personal to its recipients and should not be copied, distributed or reproduced in whole or in part, nor passed to any third party without written authorization of Bankinter Seguros de Vida.

Bankinter Seguros de Vida, S.A. de Seguros y Reaseguros

Registered office: Avda. de Bruselas, 12, 28108, Alcobendas Madrid, Spain

Bankinter Seguros de Vida, Branch office in Portugal

Praça Marquês de Pombal, nr 13, 3.º floor, 1250 162 Lisbon Corporate Tax Number (NIPC) 980545587, C.R.C. Lisbon

Bankinter, S.A. – Sucursal em Portugal

Praça Marquês de Pombal, nr 13, 2.º floor, 1250 162 Lisbon Corporate Tax Number (NIPC) 980547490, C.R.C. Lisbon, Portugal Registered in Autoridade de Supervisão de Seguros e Fundos de Pensões (ASF) to exercise the activity of Bank sold Insurance Operator, with number 0V 0028 (22/02/2016) in the Life and Non Life insurance activity. Bankinter, S.A., Branch office in Portugal, registered at Banco de Portugal under No. 269, in the capacity of intermediary, does not bear risks, does not enter into insurance contracts in its name and is not authorized to receive insurance premiums to be delivered to the insurer. Information on the intermediary available at asf.com.pt.

Support documentation

Be aware that the following information is only available in portuguese.

-

TS Gestão de Carteiras 1

-

TS Gestão

de Carteiras 2 -

TS Gestão de Carteiras 3

-

TS Gestão de Carteiras 4

-

TS Gestão de Carteiras 5